Amid tightening response to COVID-19, US shoppers do their part to flatten the curve and start pondering longer-term impacts.

Last week, we took our first look at the changing reality of US shoppers finding themselves in the beginning stages of the COVID-19 pandemic. We found that as of March 9 and 10, their pulse was elevated, irregular. About a quarter of respondents were already reacting to COVID-19 by changing their grocery shopping behavior as they focused on taking early precautions.

Much has changed since last week. More cities and states have declared an emergency, and the news from other countries, such as Italy, has been shocking and upsetting. This week, we reached out again to some 500 US shoppers to take their pulse. And to help us understand what is going on in the minds of US shoppers, we invited Carrie Shea and Mary Cooper from IRI Growth Consulting to share their thoughts and perspectives.

Pulse check on March 18, 2020: Racing.

Rasto Ivanic, GroupSolver: Looking at the data from the second pulse check, what do you see in shopper responses? How would you describe US shoppers’ pulse today?

Mary Cooper, IRI: I think there is heightened awareness and increasing concern about COVID-19. The amount of shift in one week has been quite significant.

Carrie Shea, IRI: I would agree. The pulse is racing, anxiety-producing, and there is a soberness to the fact that this situation is not going away anytime soon. Like marathon runners, we as consumers will have to train our bodies and minds to deal with the long-term toll this crisis will take on our bodies, families, and economy. Hopefully, with time, we will individually and as a society get acclimated and the anxiety levels will come down.

RI: Besides observing a significant change in behavior in just one week, one of the things that did strike me was that it is the older respondents who are slowest to change their behavior in response to COVID-19. Why do you think that is?

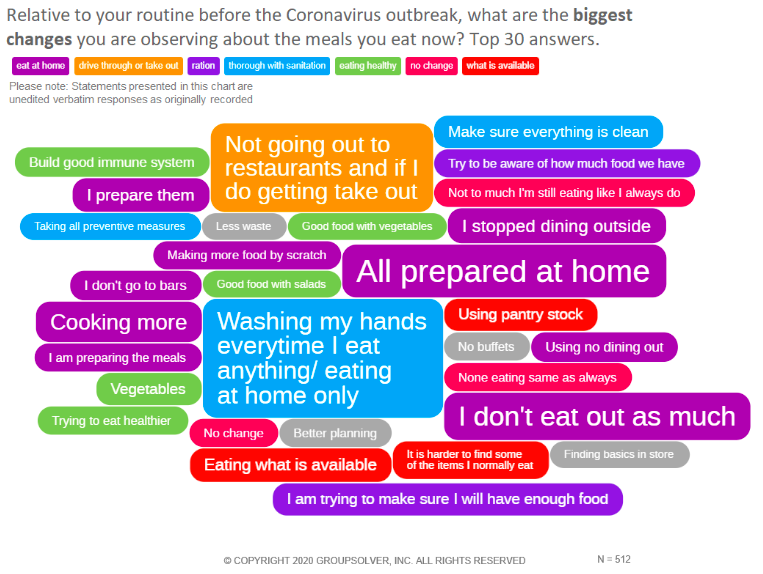

CS: I suspect that the younger consumers are shopping more, because they are not eating out as much. Out-of-home dining has declined in parts of the country, as in-restaurant dining has been prohibited, and I suspect delivery orders are not keeping up with the loss of in-restaurant dining. Obviously, there is a lot of pantry loading going on right now, but we need ways to better understand how different demographics are more or less likely to cook at home versus order in.

RI: What are your hypotheses about potential behavior changes, new habit-forming implications that are a result of this shock to the system? What may be changing permanently?

CS: I think there are going to be some specific consumer segments emerging during this coronavirus outbreak. We will likely see a comfort food segment, whose eating habits shift to comforting, perhaps less healthy foods. Whereas we might find another segment that will seek out very healthy foods to build their immune systems. We might find another group that is motivated by gaining a sense of control during these times of chaos, and they may turn to specific types of food or eating rituals to feel more in control. We are carefully tracking social media posting to understand what new consumer “tribes” are emerging.

MC: Building on that thought process, I think that people will stock their homes better in the future and stock with healthier foods and cleaning supplies. Maybe we will have more germaphobes as a result of this crisis. I also think there will be an overall shift of what people are doing online. Setting up some online behaviors on autopilot, such as pet food deliveries, subscription services or ordering groceries on Instacart, may emerge as something we “set and forget.”

CS: I would just add to Mary’s point, I anticipate we will see a number of companies offering pantry management solutions (automatic replenishment solutions delivered to your door).

RI: This pulse check shows that only about 40% of US shoppers are doing grocery shopping online, and that number stayed the same in the first few weeks since COVID-19. You are saying that this is a number worth watching?

MC: Absolutely. This would be an interesting indicator to watch. I think it is going to move up quickly in the next couple of weeks.

RI: Speaking of eating meals at home, another sharp change we found is the decrease in the number of people who do takeout and delivery.

CS: I think there are still some people out there who are maybe older and have no other choice but to order takeout and maybe some younger people too who are ordering on GrubHub.

MC: What I am wondering is how will the looming fear of unemployment impact this behavior? Think about the office workers and tradesmen who eat out every day and now have no or more limited income. They may need to or choose to eat at home every day.

RI: This brings us to another change from the last pulse check, and that is people are now starting to worry more about the future after the virus and what the economic implications may be.

CS: Right, I think that immediate shock to the system happens, our world becomes very small and we think hour to hour, day to day, and we think about our loved ones. But as the crisis continues, and the turmoil becomes the new reality, we will start to think more about the longer term and how this shock will ripple through humanity and our economy. When we look at the news we are getting from other countries, from Italy for example, it is almost as if we could see our potential future and it is scary.

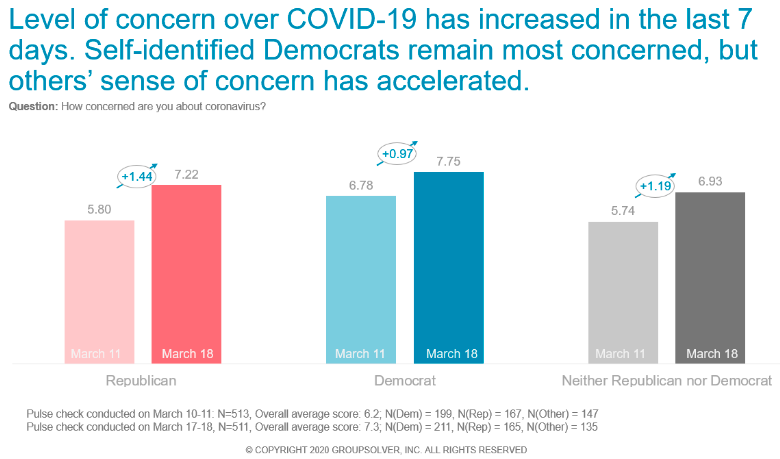

RI: Thinking about how the news and information impact our perception of the COVID-19 pandemic, we are seeing that the general concern level has increased since last week, particularly among Republican respondents.

CS: We did see last week that people who consume certain types of media tend to be more or less concerned about this pandemic. Speaking as a lay person, it seems to me that in the last week, some liberal-leaning organizations have moderated their tone, while some conservative media outlets have become more somber. I think the media’s change in tone is what is impacting consumer concern levels.

RI: Maybe we can close with some good news. What this survey is suggesting is that people are really starting to take action. More than 90% of our respondents are saying they are handwashing, they are staying at home, and they are practicing social distancing. They seem to be getting behind the idea that we need to do something now.

RI: Thank you for your time, Carrie and Mary. Before we wrap up, what are some of the big questions you are hearing from your clients and from the industry we should be asking next week?

MC: I would be interested in understanding better the impact on e-commerce and the types of foods people are eating. We can already see some long-term impacts emerging. Can we start distilling temporary from permanent changes?

MC: I can’t help but wonder what people think about the duration of the crisis. When will it be over?

RI: These are great questions! Thank you for your time, and I am looking forward to talking with you next week!

~

Carrie Shea is a managing partner at IRI Growth Consulting with a wealth of experience in growth consulting and consumer insights. Mary Cooper is a senior principal at IRI Growth Consulting with a focus on CPG and Retail. Rasto Ivanic is a founder and CEO of GroupSolver.

Do you have a customer insight question you would like solved? #FridayInSight has your answer! We’ll design a study, collect data on the GroupSolver® platform, and share with you a free report with our findings. Contact us at marketing@groupsolver.com.